The copyright market is a volatile beast, known for its dramatic swings. This volatility presents both opportunities and challenges|poses a dilemma|makes things {tricky|. When faced with these price variations, the age-old question arises: should you hodl or sell?

Hodling, essentially holding onto your coins regardless of price fluctuations, is a popular strategy|common approach|time-tested method for long-term investors. It requires resilience, as market dips can be anxiety-inducing.

Conversely, selling your copyright when prices shoot up might seem like a lucrative move|a smart decision|a tempting option. This approach allows you to capitalize on gains|take profits|maximize returns, but it also carries the risk of missing out on future price spikes.

- Ultimately, the best course of action depends on your individual circumstances.|The decision to hodl or sell is a personal one|Factors such as your risk tolerance, investment goals, and market outlook should guide your choice.

Decentralized Finance: The Future of Money?

Decentralized Finance (DeFi) is quickly becoming a movement check here to be reckoned with in the financial world. This burgeoning ecosystem leverages blockchain technology to create innovative financialinstruments that operate outside of traditional systems. DeFi protocols facilitate a range of functions, including lending, borrowing, trading, and even insurance, all directly. While still in its nascent stages, DeFi has the potential to disrupt how we interact with finance, offering greater accessibility to individuals.

Concurrently, there are challenges that must be resolved before DeFi can truly succeed. Security remain key issues of debate, and the complexities of blockchain technology can be intimidating for some users. Nonetheless, the promise presented by DeFi is undeniable, and its continued development will undoubtedly shape the future of money.

Jumpstart Your copyright Trading Strategies for Beginners

Venturing into the realm of the dynamic world of copyright trading can seem overwhelming, but it doesn't have to be. With a well-structured strategy and a touch of knowledge, even beginner traders can navigate this exciting market. Start by understanding the fundamentals: research different cryptocurrencies, evaluate market trends, and familiarize yourself with essential trading terms. Consider diversifying across various cryptos to mitigate risk.

- Utilize technical analysis tools like charts and indicators to recognize potential trading opportunities.

- Establish clear profit targets and stop-loss orders to manage your risk exposure.

- Initiate with small investments until you accumulate confidence and experience.

Bear in mind that copyright trading involves inherent risk. Stay informed, be persistent, and gradually refine your strategies over time.

Unlocking the Potential of Altcoins

The copyright space is constantly evolving, with new and innovative projects emerging regularly. While Bitcoin remains the most well-known copyright, altcoins are gaining significant attention for their varied use cases and potential for expansion.

Traders are increasingly recognizing the value that altcoins present, as they offer diversification to a wider range of sectors. From decentralized finance, altcoins are revolutionizing various aspects of our financial world.

To harness on this potential, it is important to stay informed. Evaluating the underlying project behind each altcoin is fundamental for making informed investment decisions.

Keeping abreast with industry news, updates, and expert opinions can also offer guidance. As the altcoin market continues to evolve at a rapid pace, agility will be key for success.

The Rise and Fall

Bitcoin, the revolutionary copyright/digital asset/virtual money, emerged in 2009 amidst a landscape of burgeoning technology/innovation/progression. Created by the enigmatic Satoshi Nakamoto, its decentralized nature and potential/promise/opportunity for financial freedom/independence/autonomy quickly captivated investors/enthusiasts/early adopters. Its value soared through cycles/periods/eras, reaching record highs in 2017, fueled by a wave of speculation/investment/interest. However/But/Conversely, this meteoric rise was followed by a dramatic/precipitous/steep fall/decline/crash, leaving many investors disheartened/wounded/devastated. The volatile/unpredictable/erratic nature of Bitcoin has become a hallmark of its existence/journey/history, raising questions about its long-term viability/sustainability/relevance.

Conquering the Art of copyright Day Trading

Day trading cryptocurrencies is a high-octane game that intense focus, lightning-fast reflexes, and a gut feeling for the market. It's not abouttrading assets at random; it's a calculated dance of strategic analysis, risk management, and interpreting the ever-shifting tides of blockchain technology. Successful day traders are analysts, constantly monitoring charts, news feeds, and market sentiment to leverage fleeting opportunities.

The key is to develop a comprehensive trading strategy that aligns your personality and risk tolerance. This may involve employing technical indicators, conducting fundamental research, or blending both approaches.

Bear in mind that day trading copyright is a extremely volatile endeavor, and losses are a inevitable part of the journey. It takes perseverance to stay on track, manage your emotions, and prevent impulsive decisions.

- Start by educating yourself about the copyright market and different trading strategies.

- Practice with a demo account before risking real capital.

- Define clear trading goals and risk management rules.

- Remain informed about market news and developments.

- Be patient and disciplined, and ever chase quick profits.

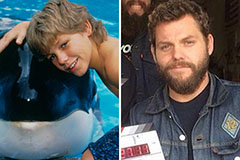

Jason J. Richter Then & Now!

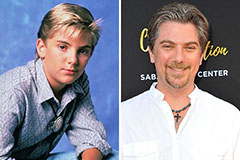

Jason J. Richter Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now!